Have we seen the peak oil prices for the next few years?

oil prices analysis

last week we saw crude oil made some kamikaze moves from record levels of 72.80 at the beginning of the week and closing the week on 67.24 $ - more than 5% move ( its a lot )Heavy volumes of over 700,000 contracts for July WTI crude its massive daily range of $3.31 between high to low

The bearish action accrues due to some factors :

Donald Trump said in April: “Opec is at it again.” He tweeted: “Oil prices are artificially Very High! No good and will not be accepted!”

Opec’s secretary general, Mohammad Barkindo, said on Friday that the tweet had sparked a discussion about easing production cuts. “We pride ourselves as friends of the United States,” Barkindo said.

Opec and Russia are likely to increase production by about 1 million barrels a day, they have meeting month would likely result in them agreeing to increase production.

The surprise EIA inventories surplus, statements from OPEC

|

| crude oil forecast |

crude oil technical analysis

if crude oil Break down 65.40-60 will confirm for more downside corrections to 62.10-40+_

We can see strong resistance on 72.80 price level

The crude made a significant move last week drop sharply last Friday and broke 70 $ price level, settle the day at lows prices 67.42$, now from the closer look on the charts we can see that rebound correction moves could come to 70.10 price levels from 64.50 apx – if it will take support there

| |

|

|

| wti analysis |

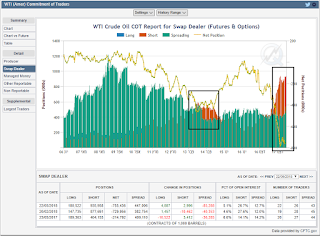

crude oil position map overview :

from looking on cot position map we can notice in the same behavior as happen in 2014

if that the case again this time, then we should expect more pressure on crude oil prices

it will be interesting

|

| crude oil position |

This review does not including any document and / or file attached to it as an advice or recommendation to buy / sell securities and / or other advice

No comments:

Post a Comment