Will the Gold price go 1400$ Or 1100$ Following Last majors events in the world?

gold prices technical analysis update following last events

gold trading above $1,300 will it go to 1400$ Or 1100$ ?

Political risk both related to North Korea and the U.S. debt limit remain high and the soft non farm payrolls report may keep the gold on the high levels

On Friday, gold rallied after the U.S. economy created only 156,000 new jobs in August versus the expected 180,000. The Bureau of Labor Statistics also said that the unemployment rate inched up to 4.4%, while July’s figure was revised down to 189,000 from 209,000. In response to the data, gold jumped briefly to a fresh 11-month high at $1,334

We have also others facts on the us dollar and gold prices such as Hurricane Harvey, which could spell out less monetary policy tightening this year.

Hurricane Harvey’s impact likely means that there will be some job losses in Texas and lower economic activity. At this point, the Fed may still raise rates in December, but if we get bad data, which is very likely, the market may revise its rate hike expectations

Latest North Korean missile test on Sunday, which is likely to send investors seeking safe havens, this risk-averse sentiment is expected to carry over to international equity markets and boost for gold prices

North Korea early on Sunday conducted its sixth and most powerful nuclear test, using an advanced hydrogen bomb. The detonation is the latest escalation of tensions between North Korea and other countries including the US and its Asian allies, after Pyongyang sent a missile over Japan last week.

Gold price technical analysis view :As long as gold xau/usd stay and trade below 1374+_ the trend became bearish, but as long as the gold remain above 1291 I’m expecting to meet 1347 1333 1326 1315 areas - break down 1291 level will lead the gold go to 1247-1256, while we need to watch at 1268-1274 area.

Also there is the price band is imprisoned between 1170 and 1370

Strong support: 1224-1233 price areas are meaningful numbers

|

| gold analysis |

|

| gold forecast |

Gold position map :

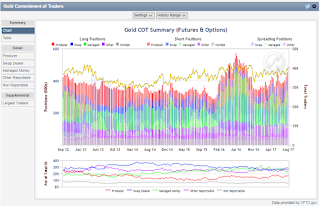

we can see at CME Cot report that there is more room for big move: take look on the spreading and position, I’m expect to see strong decline /decrease on the position before the trend will change, till then the trend is remaining negative as long gold prices remain below 1370+- price

|

| gold cot position |

The interesting thing that caught my eye, and worth paying attention to, is the position map

See for yourself the behavior of positions in 2011-2013 and now

Will this also lead to a decline in the price of gold or whether it indicates a change in direction

In my opinion, this time too, it will lead to a downward trend

|

| gold position map |

This review does not including any document and / or file attached to it as an advice or recommendation to buy / sell securities and / or other advice

No comments:

Post a Comment