Will The Brexit Bring FTSE 100 Exit ….

Will The Brexit Bring FTSE 100 Exit ….

I wıll start wıth some economıc and fundamentals stuff ,my taught for UK economy are much more positive than negative ,those are my reasons :

Positive impact on inbound tourism to Britain

Tourists vote with their feet for Brexit - in May began to spend more money in the UK, and now the Chinese flock to tourist sites that offer holidays in the UK, The fall of the pound is a boost for Tourist

Money sitting on the fence + Zero interest

Hedge funds and institutional investors are sitting on a lot of money available, current number, showing the almost 7% of the cash. Typically, the rate exceeds 5%, is an indicator that the rally in the markets, that too many people sit on and be tempted to enter

Immigration policy and immigrants

UK retirement Union actually brings her to form an independent immigration policy and to decide for itself on European immigration policy independently, Less spending on occupancy and solutions for immigrants - will lead to more money in the till

Britain has not really been a full member of the European

Even before Brexit is formalized, U.K. is outside a lot of Europe’s circles of authority, By choice, it’s not 1 of the 19 countries using the euro currency.

UK also not part of the 26-nation Schengen Area, which prohibits border controls between members.It’s inside the EU’s Customs Union, a free-trade zone that negotiates tariffs with nonmembers

|

| ftse100 Brexit |

The stock market impact

The stock market reaction may eventually prove overblown given that the theoretical long-term economic , damage from Brexit is just 2 per cent of UK GDP, plus if we will look on the company's the GBP rate can improve their results cause it can give a boost Fitness higher competition, exports, and competitiveness in the world

Markets Sentiment

Indexes for volatility are already lower than they were in February this year, suggesting that markets are not abnormally worried about the outlook, and UK government borrowing costs are at an all-time low.

Despite reports of markets crashing following the Brexit result, when you put the current level of volatility in a context of other shocks, market conditions are not as bad as they might seem. The FTSE 100 is still higher than it was barely two weeks ago and the more UK-focused FTSE 250 is currently higher than it was in late 2014. This is the kind of volatility that markets see two or three times a year

The effect of the decline in value of the pound

The fall in the value of the pound following the Brexit result is also not as bad as it may first appear. The size of the fall was exacerbated by the previous day’s assumption that Remain would win. There is also precedent for a dramatic fall – after the ERM crisis – which proved beneficial for many British exporting companies and arguably helped sustain the economic recovery of the 1990s

|

| FTSE 100 London |

Now after mentation supposedly fundamental economic reasons, let's move on to some really interesting view

FTSE 100 Technical analysis view

It may seem ridiculous to some of you, or out of touch, but I chose to bring it to your information

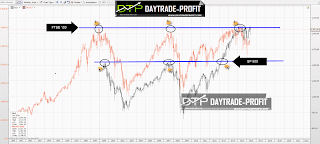

Note resemblance to the outline, between the SP500 to FTSE100

While sp500 broke the record triangle between the years 1999-2012 and reached new highs

FTSE did not, but which is the greatest grief if correlation and similarities we look

I would not be surprised, and even supports the scenario of going to new heights similar to sp500

All this off course depend on the FTSE behavior

Retained the pattern price above the level of 5700 points

You can see the corresponding price channel, created the index highs and lows

|

| FTSE VS SP500 |

|

| FTSE 100 FORECAST |

This review does not including any document and / or file attached to it as an advice or recommendation to buy / sell securities and / or other advice

No comments:

Post a Comment