Is sanity back into the stock markets?

Markets Technical Analysis

When the headlines explode into over-optimism / over-pessimism, prepare for a revolution

On March 13, they made headlines:

"U.S. Major Indexes All Enter Death Cross"

What happened?

The market has corrected sharply upwards:

Nasdaq from Area 12900 to Area 15200

S&P 500 from area 4130 to area 4630

On May 20, they made headlines again:

"Stocks continue to fall, Wall Street enters a bear market "

What happened again?

As of this writing

The market has corrected sharply upwards:

Nasdaq from area 11560 to area 12800

S&P 500 from area 3860 to area 4170

Now let's go see what we have and where the markets are headed

I suggest to those who have not read my reviews since the beginning of the year a peek and get an idea of the preparations we had before this whole move, as well as up and down trading targets

|

| Markets outlook |

Now the question is whether we have another wave going down or the declines have ended: it is too early to say that the declines have ended, now the market is in the process of declining

Nasdaq:

Need to see what is happening in the areas of 12800-13100 is critical

If the levels of area 13200-13300 are broken on a daily basis, then the target of area 14200-14500 is on the horizon, on the other hand, a correction at this stage to area 12400 + _ is quite likely for those looking for a long-distance connection

Alternatively, a decline from area 12030 downwards signaled continued weakness in the market

Important thing: In terms of trading bands and oscillators that I work with: I have said more than once or twice, that I see a stop at Nasdaq in the area of 11680 points, and I aimed there in January this year that the market trades in the area of 14600 + _

|

| Stock Markets outlook |

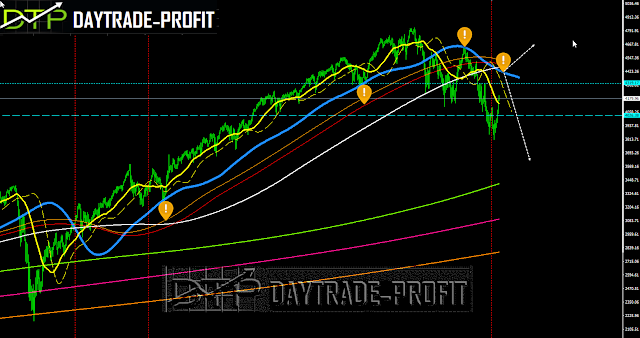

S&P 500:

Need to see what is happening in the areas of 4160-4200 are critical

If these levels of area 4230-4260 are broken on a daily basis, then the target of area 4430 + _ is on the agenda when before that there is the area of -4360 -4320 + _, on the other hand, a correction at this stage to area 4100 - is quite likely for those looking for a long way

Alternatively, a decline from area 4020 downwards signaled continued weakness in the market

To summarize things - in the short term:

stay Long is a trend as long as the S&P 500 is trading above 4020 points levels

Short term: Breaking down area 4020 will lead to 3930-3960 area with licking to 3850 - Below the story changes!

Long term - bail to blue strip cross up again (4410-4430 pints)

|

| S&P 500 technical analysis |

conclusion

S&P 500- Only Breakthroughs areas 4410-4430 Will Return the Market to a Positive

NASDAQ- Only Breakthroughs areas 14200-14500 will return the market to a positive

it's currently in the process of a drop-off facility - we have not yet moved into positive territory

No comments:

Post a Comment