Weakness of the dollar Signs of a change in the air, or an eyesore

forex technical analysis

The U.S. Dollar trading lower against a basket of major currencies

As optimism increased demand for risk assets and by a positive movement toward a coronavirus vaccine and the European Union is passing of a massive stimulus

US dollar index (DXY) dropped to 18-month low trading at $95.11, which is close to its lowest level since January 2019. It has dropped by more than 5% in the past three months.

The US dollar index measures the performance of the dollar against a basket of global currencies

In the past four months, most of those currencies have gained significantly against the dollar.

The euro is currently trading at its highest level in 18 months while sterling is at its highest level since June. Similarly, the Canadian dollar has spiked to its June highs while the Swedish krona has jumped to its January 2019 highs.

Those currencies have jumped because of the improved sentiment in their countries. For example

Euro has rallied because of improved economic data from the eurozone and the falling number of coronavirus infections. The funding deal passed yesterday has provided more momentum in the eurozone.

The British pound, on the other hand, has rallied as investors play down the immediate risks of a no-deal Brexit. Instead, they have focused on encouraging data from the UK, the support from the Bank of England, and the falling number of new infections.

US recovery slows as considers another round of fiscal stimulus. In a statement yesterday, Mitch McConnel, the senior Republican said that he supported a new stimulus package.

now lets test some currencies :

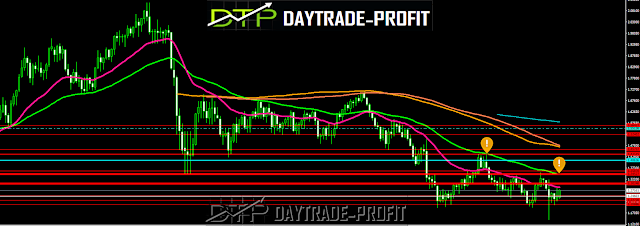

EUR USD TECHNICAL ANALYSIS

support 1.1440

resistance 1.1620-1.1670

target 1.1860-1.1930

AUD USD TECHNICAL ANALYSIS

support 0.69100

resistance 0.7160

target 0.7280-0.7340

|

| AUD USD |

GBP USD TECHNICAL ANALYSIS

support 1.2530

resistance 1.2760

target 1.31-1.34

|

| GBP USD |

NZD USD TECHNICAL ANALYSIS

support 0.6540

resistance 0.6720

target 0.6970- 0.7040

|

| NZD USD |

This review does not include any document and/or file attached to it as an advice or recommendation to buy/sell securities and/or other advice

No comments:

Post a Comment