Has the trend changed in Gold and silver or is it just a short pause

gold and silver technical analysis

gold and silver technical analysis

Gold price increased as much as 2 percent to hit a new all-time high of $1,980.57 per troy ounce on Tuesday morning in Asia, before falling back sharply in the London session to $1,907.

Silver also rose as much as 6.4 percent to $26.19 per ounce during the Asian session, before tumbling to $22.3

This works out well with the last post: Weakness of the dollar signs of a change in the air, or an eyesore

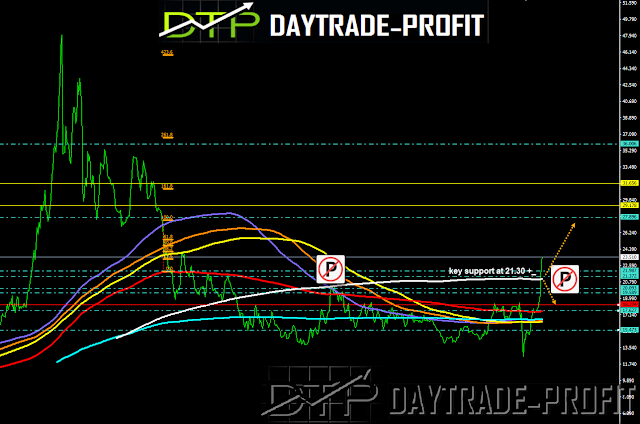

Silver technical analysis

If Gold continues to rally as Silver rallies, then future measured moves should target 29.10 $ $31.60 and even $36.05 in Silver – possibly higher.

The key support stays in 21.30$!

|

| silver analysis |

Looking at the broader picture, analysts Research says the dollar's weakness is just one factor behind gold's rise; add china US tension and COVID 19

"The collapse in real yields has been the link between easy policy and gold. As central banks inject liquidity, real rates decline and the opportunity cost of holding gold recedes. Central banks remain successful in their easing attempt. Even if nominal yields are flat or slightly up, inflation expectations continue to rise and real yields to fall,"

For gold Closing, today is very critical

Below the 1943-1957 area, it indicates a short-term weakness and we are heading to check 1843-1868 price area

|

| gold analysis |

No comments:

Post a Comment