Does Turkish Lira back to high volatility and the days of grace are over?

Turkish lira Analysis News

Losses for the Turkish lira deepened last week after Ankara's deteriorating relationship with Washington - The Senate Foreign Relations Committee last week passed the Risch Bill, which aims to impose sanctions on Turkey for its purchase of Russian-made S-400 missile defenses and its latest offensive in Syria.Turkish lira slide to its weakest level in daily trade since May and volatility gauge was at its highest since late October

U.S. President Donald Trump has signed a defense bill, which imposes sanctions on Turkey over Ankara’s decision to acquire Russian S-400 missile systems

In response to that, Erdogan warned at the weekend that economic sanctions under consideration by the U.S. Senate, which may be implemented in response to Turkey’s purchase of Russian S-400 air defense missiles, could result in his government barring U.S. access to a key military base at Incirlik in the south of the country

|

| Turkish lira Analysis |

To simplify the situation of the Turkish lira, here is the story

Last 3 months we saw an audiovisual show of the Turkish Lira mention here

not once that Turkish lira located in

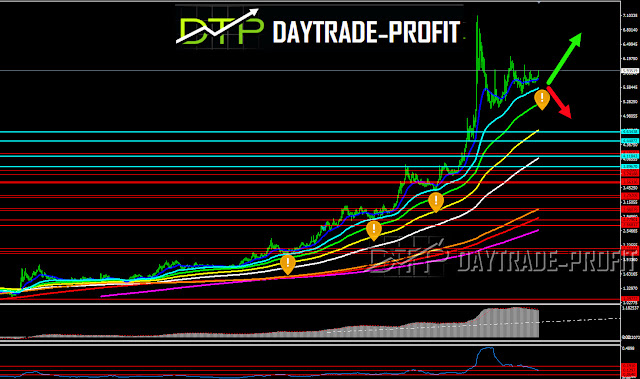

Turkish lira Technical analysis

Long-term trend forecast moved is still up as long as 5.30+_

will hold!

Break below 5.57 will send the Turkish to 5.31

close below 5.06 - will confirm for

more down moves.

Break above 6.26 will send the Turkish

again to higher levels - below these levels; you need to watch long-term trends

mentions above In terms of behavior

If top will break up again, Goal is standing on 7.89-8.72 - look again on the charts I found that if this case is the same as 2001 to 5.06

price area is can be shown on the charts

Short-term trend forecast: as long as Turkish lira will trade below 5.13 the

target is located in 4.30+_ price area with an option to went down over to 4.11

Daily closed above 6.26+_ will confirm that

the correction is over!

|

| Turkish lira chart |

This review does not including any document and / or file attached to it as an advice or recommendation to buy / sell securities and / or other advice

No comments:

Post a Comment