Will we have a third time today in the markets - ice cream or watermelon ?

Market’s Technical Analysis Forecast

What two days were seen on the markets - crazy days .... what we should expect for today (NFP )?

In my opinion

Nasdaq Region 7710 + _

SP 500 2924 +- break there will be sent the sp500 to cope with 2868 level

Dow Jones 26,400 + _

Those are important areas if they do not hold there then things can deteriorate - if so then we will again move up until ........

August and September are summer months where activity tends to be more sparse due to summer holidays around the world

P.S look my last post on the markets: Is the road paved and safe for the continuation markets journey?

|

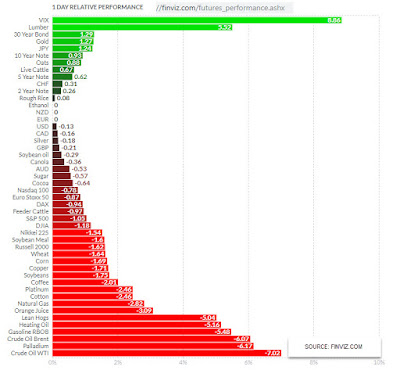

| MARKETS performance |

As you already know USD JPY pair tend to be sensitive to so many other markets..- we are seeing the stocks markets start making Hints of weakening and it's reflecting on this pair

(The safe-haven demand for the Japanese Yen is somewhat decreasing as the global risk sentiment has momentarily stopped worsening)

USD/JPY pair move along with the stock market, if the stock market breaks down it could be a sign of “risk-off” and if that’s going to be the case, it’s very likely that this pair will go looking down

A breakdown below 106.40 would be rather negative and could send this market down to 102 level - break this level will extend the downtrend towards 98.70- 96.70- support

|

| Technical Analysis Forecast |

If we go back and look at the trend and behavior of the USD / JPY

pair we can see some interesting things

You do not have to go too far, you can look at the pair's

analysis in

2016 - before Trump's election I wrote a review of the pair, the goals were

achieved, but that is not the essential issue

What is essential is the future expectation of the move, by

looking back at the years 98-99 that still show me the same pattern

"Once again I turn your's attention to 1998-1999

This review does not include any document and/or file attached to it as an advice or recommendation to buy/sell securities and/or other advice

No comments:

Post a Comment