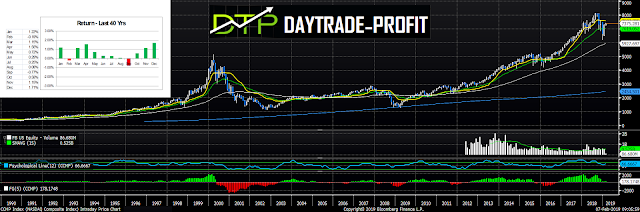

February Statistics Effect in the Stock Markets

Markets Statistics Analysis

The markets jumped

wildly and made a stunning correction in January - most of the major reports

behind us

From a seasonality perspective, February isn’t as bullish for stock market -The month of February is very deceptive - check me out

We'll see if this time too it will happen

It usually closes at the levels it opens

But within the month there are declines - what I'm saying is that ... I'm 70% likely to think we'll see an upturn in these gains

|

| markets analysis |

There are a few things

you should pay attention to:

The indices reach

extreme levels before the journey continues upwards, or is this the end of the correction?

Facebook has released

reports yesterday and costs over 11% - comes to check the Gap, the refractive

levels of the rising move: if it closes above the $ 171 area, we have a set up

here to catch a move to close the top - it's worth watching closely!

Amazon, as I have

mentioned several times, should cross the 1760 area in order to show a

continuing upward trend!

If the conditions that I

have mentioned exist, expect another incremental move

If not then the story is different:

a stock that can hint us

what is to come in the markets - keep in mind that there may be a situation of

V SHAPE in markets - how do you will know this ... 1999

again in the headlines

I will focus on the NASDAQ :as i mention before cross above 6950 -7078 levels will confirm more up while staying below will show us its only a correction to the declines the markets have experienced

now lets check the charts : Assuming that we are experiencing an implementation here, I think that the levels to which we need to pay attention to make decisions

6860 - 6730 -6650 -6578

A healthy correction that will give the signal for a further upturn in the markets should show support at the 6578 points level - breaking below significantly increases the likelihood of a bounce back down! , While breaking the levels above (6950-7078) will lead to a new record, which means V shape, It will be interesting and there is definitely what to expect

A reassessment or a

healthy correction to the violence experienced by stock indices

This review does not including any document and / or file attached to it as an advice or recommendation to buy / sell securities and / or other advice

No comments:

Post a Comment