Until when the Euro-Dollar pair will be traded in a shuffle and indecision trend ?

EUR USD Technical Analysis

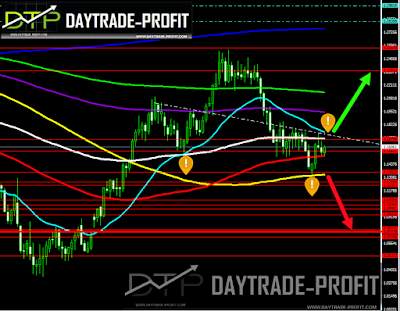

With your permission this time, I will start with Eurodollar borders because I think this shuffle begins to confuse the traders in making deals and unnecessary tradingThe assumption is very simple at the moment: In the long run, I'm bearish on the pair and I think it will go down to check the open gap which is somewhere down there and even fall below 1, but that's a big but now it's not the case yet.

In the daily and short-term, there is a struggle between the buyers at the 1.15-1.17 level. If we take a closer look, we can see that the clear boundaries for the pair to determine the long move are in the following areas:

From below the 1.1350 + area will be sure to signal a major bearish move for the pair

On the other hand, the resistance area is at 1.1850 + whose breach will signal a change in trend and a bullish breach of the Euro

|

| EUR USD analysis |

As I wrote last post EUR/USD we will see retracement – closed daily above 1.1430 will lead to 1.1630 and even more up targets such as 1.1670 and even 1.1740

|

| EUR USD chart |

Technical analysis:

After the last retracement - we saw EURUSD took off 1.1630 – and reached to 1.1670 – targets were mention, also we saw EURUSD took off 1.1530 down and recover, Next target area, if the price will remain up above 1.1670, is 1.1730-1.1770 – if those targets will break up we need to expect for more up moving in EURUSD to 1.1860-1.1910 – see inverse head and shoulders pattern – SHOWS THE SAME TARGET

Support resistance stay in 1.1530-00 while break again last lows combined strong support at 1.1350 will confirm for more downtrend to closed old GAP from 2016 who located in 1.0770 price area

|

| EUR USD technical |

This review does not include any document and/or file attached to it as an advice or recommendation to buy/sell securities and/or other advice

No comments:

Post a Comment