Will the NAFTA agreement due to be signed next week, send the Canadian dollar to new territories?

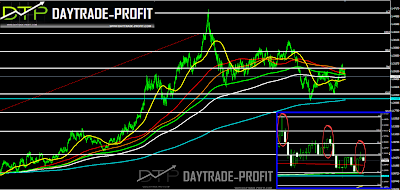

USD CAD TECHNICAL ANALYSIS

Trump is pushing for a NAFTA deal as early as next week, the NAFTA renegotiation fears are dying down, it’s also reported that in the latest US proposal regarding the car, parts are grouped into five categories. In addition, some of which could have a lower requirement for North American contents or none at all, expect this could be a medium-term bearish factor for the USD against CAD.USD/CAD Drops to 1.2744 from 1.3124 high in the last march.

break 1.2630-1.2700 will confirm near-term reversal on the downside and send usd cad retracement to 1.2560 price area.

Also, current development suggests rejection by 1.3124 level And deeper decline could be seen back to 1.2130 and below eventually put back into focus with medium-term bearishness revived, You can also see the bearish pattern in the monthly chart

Candlesticks point to continued bearish momentum in a bearish pair

On the upside, break of 1.2850-1.2930 is needed to confirm completion of the decline. Otherwise, outlook will stay cautiously bearish in case of recovery.

Canadian Dollar trading risk rewards face junction at 1.20 and 1.30 price area stay in focus

|

| USD CAD ANALYSIS |

I start to analyze usdcad when is faced with the breakpoint in 2013

This review does not including any document and/or file attached to it as an advice or recommendation to buy/sell securities and/or other advice

No comments:

Post a Comment