Busy week for the British pound, will it effect strong move on the GBP USD

GBP/USD TECHNICAL ANALYSIS UPDATE

busy week for the British pound: inflation, employment, and sales data

Will the Brexit divorce talks be judged to have reached the point at which discussions on future trading arrangements with European Council can begin? It looks unlikely but investors will nevertheless be paying close attention to the meeting of the EU’s leaders on Thursday and Friday for any signal that the future relationship between the UK and EU is on the agenda.

Theresa May has struck an increasingly emollient approach of late, Yet progress is painfully slow as EU intransigence remains a hurdle. Brexit negotiations will be discussed in ‘an EU 27 format’, meaning Britain will not be present when the topic comes up. Mrs. May will be hoping that her conciliatory and constructive attitude works better on the EU’s national leaders more than it has so far with the EU’s negotiating team.

On the data front, UK inflation figures will be closely scrutinized by sterling traders for confirmation or otherwise that the Bank of England is moving closer to a hike. After softening a touch, inflation bounced back to 2.9% in August, last month’s ONS release revealed.

Following this, the Bank of England indicated it is a lot closer to raising rates than previously anticipated by the market, a move that sparked sharp gains for the pound before it retreated as political risks appeared to swell.

BOE Gov Carney is going to Speaks this week

Sticking with UK interest rates and the testimony of the Bank of England’s newest policy-setters will be followed by an indication of when rates may rise. MPC members Silvana Tenreyro and Dave Ramsden will testify before the Treasury Select Committee on Tuesday, while governor Mark Carney is also expected to speak before MPs.

|

| GBP USD FORECAST |

Technical analysis:

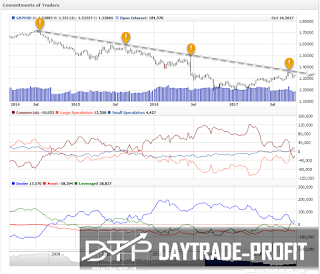

Expect strong resistance below 1.3300 to bring larger down trend resumption, while we have first to meet 1.3080. On the downside, break of 1.2840 support will indicate short-term topping. If it will fail to stay above the level it will be turned back to the downside for 1.2640 support current upside target for GBP/USD comes in ahead of this key resistance level, at approximately 1.3260- a break above this level ON DAILY CLOSE will test the trend for the GBP USD , This target was derived from the resistance (white band ) through all his decline from 1.57_+ area - mark on the chart below

As of today writing the post, the pound Sterling hovers near one-year high to1.3320 ahead of Bank of England meeting BUT CLOSED BELOW 1.3260.

As of today writing the post, the pound Sterling hovers near one-year high to1.3320 ahead of Bank of England meeting BUT CLOSED BELOW 1.3260.

GBP/USD remains mildly on the upside. Rebound from 1.3020 would target 1.3580 below 1.3020 minor support will be at 1.2860 and even more to 1.2680

On the downside, decisive break of 1.2680 key support will argue that rebound from 1.1946 has completed. The corrective structure of rising from 1.1946 to 1.3651 will, in turn, suggest that long-term downtrend is now completed.

|

| GBP USD ANALYSIS |

also, cot position shows strong resistance on 1.35-6 price area :

|

| GBP USD POSITION |

This review does not including any document and / or file attached to it as an advice or recommendation to buy / sell securities and / or other advice

No comments:

Post a Comment