Stronger US Dollar and Fed policy may lead

the precocious metals into recession in 2017

For my opinion we are going to see weakness in platinum, oil, gold and silver against the rising US dollar. Furthermore, the change in the US central bank’s policy from infinite monetary easing to indirect helicopter money will ultimately raise both inflation and growth, but only through a recession

Ill focus on these 3 commodities from precocious metal category

Gold to 986- 1028 area as long as below 1238 area

|

| gold forecast |

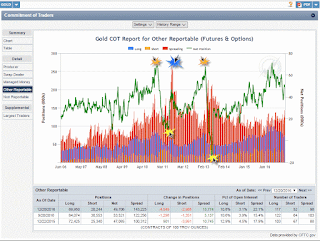

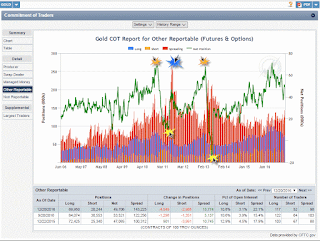

we can see at CME Cot report that there is more room for big move: take look on the spreading and position, I’m expect to see strong decline /decrease on the position before the trend will change, till then the trend is remaining negative

|

| gold cot |

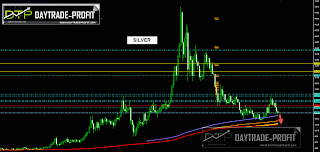

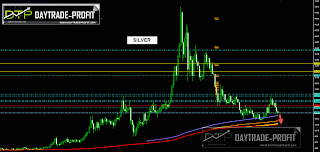

Silver to 12.50 area as long as below 17.80 area

|

| silver price forecast |

|

| xag/usd |

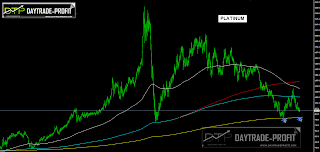

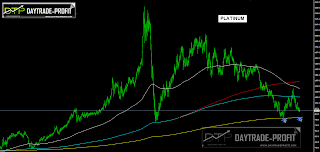

Platinum: 670-720 area as long as below 814 area

|

| platinum analysis forecast |

|

| platinum price forecast |

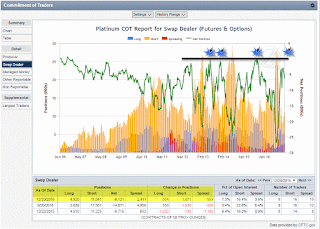

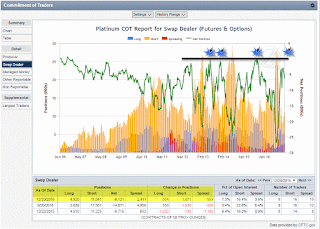

We can see at CME Cot report that there is more room for short:

|

| platinum cot data |

This review does not including any document and / or file attached to it as an advice or recommendation to buy / sell securities and / or other advice

No comments:

Post a Comment