what the past could tell us on usdcad future moves

what the past could tell us on usdcad future moves

I'm going to try and show you almost all methods you need for analyzing the usdcad , you also can read and see more sample on it ,in my blog history

The Canadian dollar continues to climb, due the oil prices continue to rise as I mention my last post on the crude oil the target will be around 40$, this will probably take the usdcad to 1.31 area although we must be aware for interest Rates, Fed Funds Rate at 16th (As we all know Canada is a major oil producer Rising oil prices are good news for cad)

A sharp reversal in the US Dollar (measured by the US Dollar index) since early May lows gained traction after the release of hawkish Fed minutes. Adding to it, renewed concerns of oversupply has dragged crude oil prices lower on Monday and eventually lifting the USD/CAD pair higher,Canada is particularly vulnerable to monetary policy divergences with the Fed because its C/A deficit is predominantly financed by debt related flows, and these bonds are regarded as relatively close substitutes with USD fixed income instruments.My expectation for the near future that usdcad will bring rebound later on to 1.32-1.34 area and from there we will get another wave that will lead usdcad breakdown 1.25 level and reach to 1.19 area

|

| usdcad |

usdcad made the same way as I expected

|

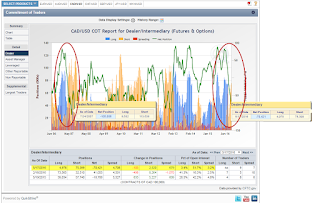

| cad position |

Don’t forget the connection between the cot position prices to cad , now we need to be focusing on the following charts – on the CME we can see the same behavior as 2007 net short position increase while long are decrease, on the retail side (Forex brokers clients) the 1.32 level could bring some break point for both sides.

|

| cadusd rate |

From technical side on usdcad let's look at the charts:

On all my usd cad posts I was talked on the long term moves and try to Draw conclusions for the future on this pair , we got the bounce and now my assumption is : scenario will be complicated and you need to be ready for a lot of movements on the usdcad,if 1.31 area will hold so the next target will be at 1.3260 area and even higher to 1.34-1.35, from the other side break down again 1.2960 will confirm more downside to 1.25 – once 1.25 break down the next level on to 1.19

Final words:

Let's test the Canadian dollar compatibility we will see oil prices the past weeks when the currency follows strong moves by the expectation, at the moment I expect for radical moves

don't surprise if the amendment to the level of 1.3260-1.35 will bring big corrections but if oil will move more than that we need to expect even stronger repair more at the level of 1.19

Let's test the Canadian dollar compatibility we will see oil prices the past weeks when the currency follows strong moves by the expectation, at the moment I expect for radical moves

don't surprise if the amendment to the level of 1.3260-1.35 will bring big corrections but if oil will move more than that we need to expect even stronger repair more at the level of 1.19

No comments:

Post a Comment